Coffee-Obsessed Koreans Say Nay to Nestlé’s Nescafé

Nestlé, the world’s largest food maker, has experienced a weak presence in Korea due to its weak market share in the instant coffee segment. Lotte Nestlé, a Korean affiliate of Nestlé, reported an annual net loss of 10.1 billion won ($7.3 million) last year, with a shrinking market share in the instant coffee segment. Domestic competitors like Dongsuh Foods and Namyang Dairy have also been gaining market share.

Dongsuh Foods has been the top provider of instant coffee with its Maxim product lineup, but its dominance accelerated in recent years. In 2014, Lotte and Nestlé established a 50:50 joint venture named Lotte-Nestlé Korea to rejuvenate their standings.

Market watchers have pointed to multiple factors behind the decline of Nestlé’s Korean operation. Until Namyang Dairy entered the coffee mix business, Nestlé did not engage in significant marketing activities, contributing to its current decline in market share. The company also failed to grasp the evolving taste preferences of Korean consumers in the coffee market.

Critics have also pointed out Nestlé Korea’s failure to adapt to the domestic distribution network, partly due to the relatively small size of the domestic market compared to other regions. The domestic food distribution network underwent significant changes at the turn of the century, with a decline in traditional retail outlets and the rapid growth of large-scale franchises focused on discounts.

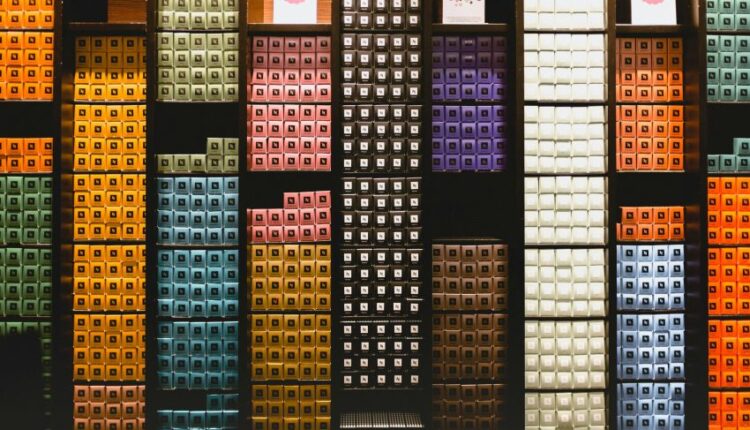

Despite these challenges, Nestlé still holds around 80 percent market share in the local coffee pod market with the Nespresso and Dolce Gusto brands.

Read More @ Korea JoongAng Daily

Source: Coffee Talk