Updates on the Tariff War: New Report Shares How Producing Countries Are Being Impacted

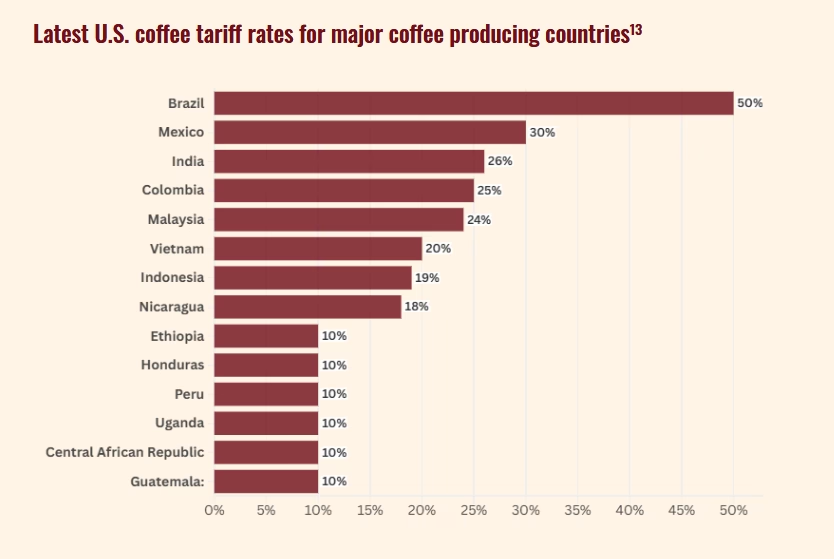

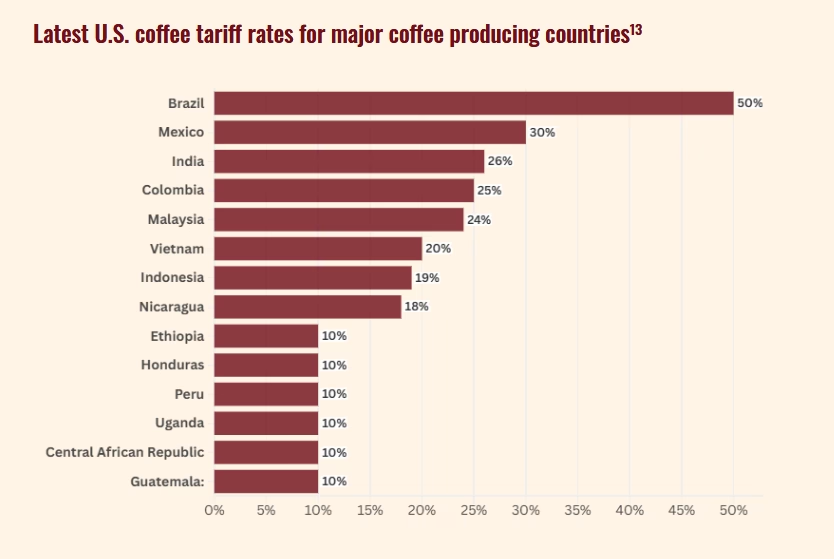

As Donald Trump’s tariffs hit origin countries like Brazil and Nicaragua, Coffee Watch urges U.S. coffee companies to take a stand.

BY EMILY JOY MENESES

ONLINE EDITOR

Featured photo by Nguyen Tong Hai Van

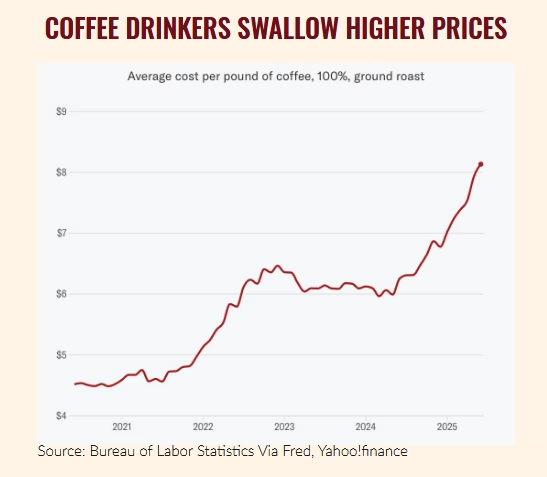

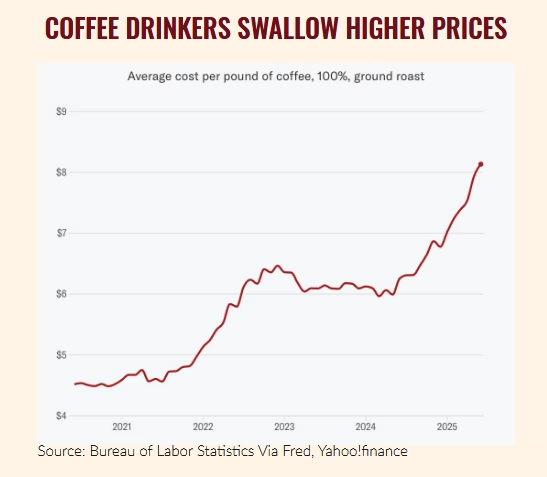

It’s only been a few weeks since United States President Donald Trump’s tariffs hit major coffee-producing countries like Brazil, Nicaragua, Vietnam, and Mexico—but consumers and coffee companies in the U.S. are already beginning to see the effects, with coffee prices ticking upward everyday.

The people most affected, however, are not café-goers in the states, but rather, farmers in coffee-producing countries. A new report released by nonprofit Coffee Watch shares how the recent tariff wars have impacted producers at origin—and how they’ve only exacerbated long-standing inequities within the coffee industry.

“This is not only about coffee. This is about justice,” says Etelle Higonnet, Director of Coffee Watch. “Trump’s tariff wars will be a poverty multiplier for coffee-growing countries . . . (they) threaten to collapse entire rural economies from Chiapas to Minas Gerais and beyond.”

It’s no secret that coffee is one of the U.S.’ favorite beverages; surveys show that 66% of Americans consume it every day, with most drinking an average of three cups per day. Because of this, coffee plays a significant role in the U.S. economy.

“Coffee generates significant wealth for the U.S. … (It) accounts for 1.2% of the U.S. GDP and supports 2.2 million jobs in the country. For every $1 of imported coffee, $43 is generated in the American economy,” shares Marco Matos, Executive Director of the Brazilian Coffee Export Council (CECAFÉ).

However, the U.S. doesn’t grow virtually any of its own coffee—it relies almost exclusively on coffee from countries in the Global South, where many coffee farmers live below the international poverty line of $3.20 USD per day. To put it simply, producing countries put in the hard work while the U.S. reaps the benefits.

Coffee Watch’s latest report shows that Donald Trump’s tariffs are further intensifying the problem, pushing communities that are already struggling even further into poverty. They also share a list of countries that will be most affected: Brazil, Mexico, Vietnam, Indonesia, and Nicaragua are among the list.

China Steps In

Early last month, China reacted to Trump’s tariffs by opening its own doors wide to coffee-producing countries, authorizing nearly 200 Brazilian coffee companies to export coffee to the Chinese market—where coffee is becoming increasingly popular alongside tea. The deal between China and Brazil is set to last for the next five years.

Coffee Watch also shares China’s announcement that it will no longer charge import tariffs on African coffee-producing countries.

While China’s action offers a new opportunity to coffee producers in Brazil and Africa, other producing countries continue to wait for reprieve.

What’s Next

In light of their findings, Coffee Watch urges coffee consumers and companies in the U.S. to continue advocating for an end to the tariff wars. “The current U.S. administration should exempt coffee from its tariff wars. Coffee farmers and farmworkers are already among the world’s poorest people, and any additional attacks on their situation could deepen their suffering,” the organization shares in their report.

“Furthermore, as the U.S. can produce only a small fraction of the coffee it consumes—and has no realistic potential to scale production due to environmental constraints—tariffs effectively penalize domestic roasters, processors, and cafés without serving any meaningful protective or strategic purpose,” they add.

The organization also points to countries acting as “role models” in regards to coffee importing, citing how Australia, Canada, and Norway have no tariffs on coffee from any of the world’s top ten producing countries.

“The E.U., U.K., Japan, and Switzerland (in addition to the U.S.) are especially problematic when it comes to their processed coffee tariffs, and civil society must urgently pressure them to address their unjust systems,” the report states.

To read the full report from Coffee Watch, click here. And for more updates, visit the Coffee Watch website here.

Subscribe and More!

As always, you can read Barista Magazine in paper by subscribing or ordering an issue.

Read the August + September 2025 Issue for free with our digital edition.

For free access to more than five years’ worth of issues, visit our digital edition archives here.

Source: Barista Magazine